Manager, Chris Cicalese, CPA, MSTFP, dives into this topic on a recent interview with New Jersey 101.5.

The IRS urges those to not try to amend the return. Many individuals filed their 2020 tax return and realize they should receive money or incorrectly paid following the passing of the recent COVID-19 relief bill. Should I amend this year’s tax return if I already filed? Instead, work with your CPA and you can claim a rebate when your file your 2021 tax return. What do I do if I received the wrong Economic Impact Payment amount?ĭoes your deposit not match what you expected to receive? While this is incredibly frustrating, the IRS is extremely backlogged with unopened mail and tax season chaos. Don’t worry! When you file your 2021 taxes, the IRS will amend the stimulus money you should have received. If you have not filed your 2020 tax return or the IRS has yet to process it, the IRS will use your 2019 return and will not be aware you should receive an additional stimulus check for the child born in 2020. What if it does not include my child born in 2020? Use the following chart to determine eligibility based on adjusted gross income (AGI). There is no minimum income needed to qualify, so you do not need to be employed in order to be eligible. Unlike the first 2 stimulus checks, adult dependents (those over 17) are now eligible. Taxpayers who qualify will also receive a stimulus payment for their dependents.

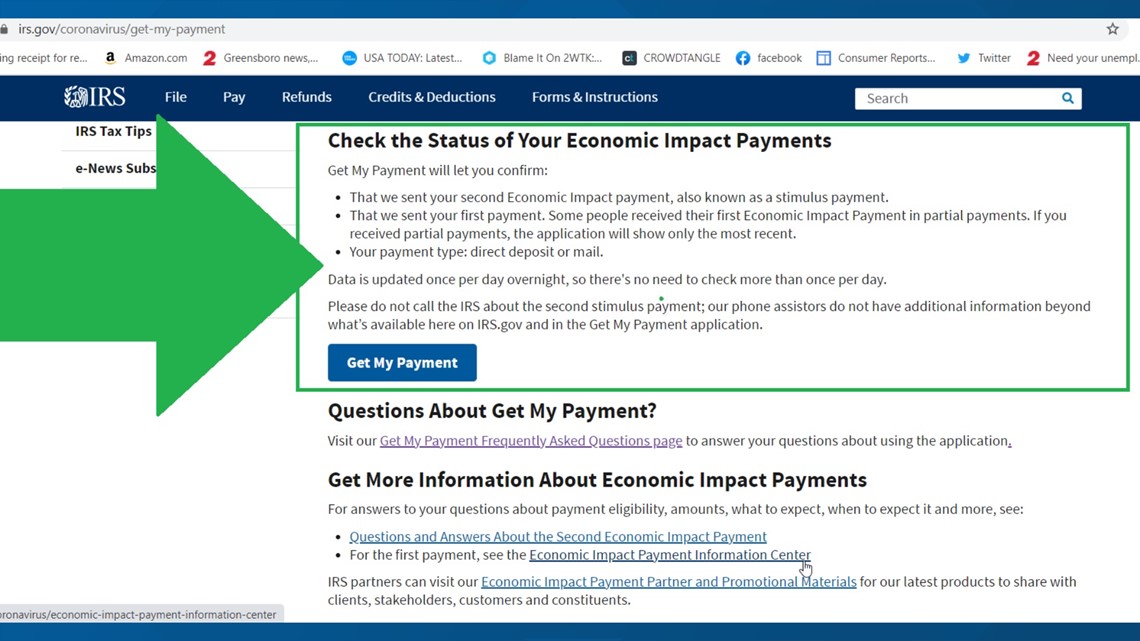

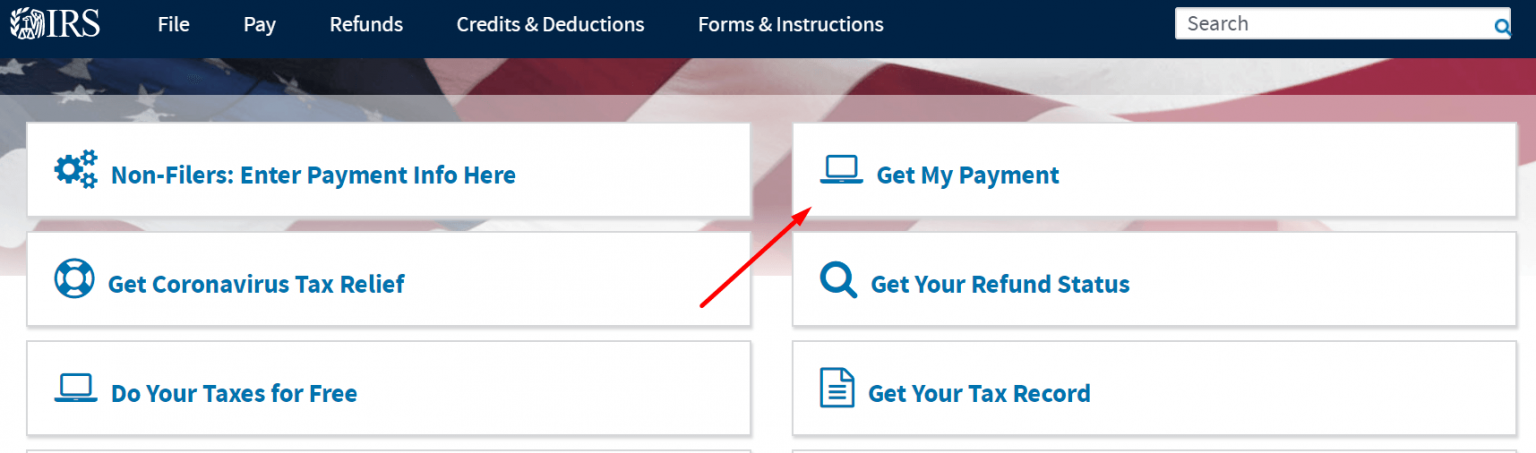

Our article concerning the American Rescue Plan Act provides information about who will receive the stimulus check. Am I eligible for this round of stimulus checks? The system will then prompt you to provide your bank account information. Lastly, it may inform you that the IRS needs more information and was unable to deliver your economic impact payment. The tool may also disclose that payment status is not available which means it has not yet been processed or you are not eligible. Another status that may show up is that you are eligible, but the payment has not been processed yet and there is no date available. It may tell you a payment has been processed, the date it is available, and whether it is being sent direct deposit or mail (you will receive an EIP card or check). Once you input your information into the “Get My Payment” tool, there are different status messages you might see. If you haven’t received your stimulus check and you believe you are eligible, you can check the status on the IRS website. How can I check the status of my stimulus check payment? If you have yet to file your 2020 tax return, the IRS will use the information from your 2019 return. As long as you have filed your 2019 or 2020 tax returns, the IRS will determine if you are eligible for the economic impact payment. Much like the first two stimulus checks, there is nothing you need to do. What do I need to do to receive my stimulus check? Alloy Silverstein answers some questions you might have about the latest Economic Impact Payments. The IRS has already started sending stimulus money into the bank accounts of the recipients. However, this time with different restrictions. The latest COVID-19 relief bill introduced another round of stimulus checks. Cloud Accounting and Business Processes.

0 kommentar(er)

0 kommentar(er)